The Student Loan Map

Apply for a Loan

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jul 18, 2021

Advertiser Disclosure: We strive to help you make confident loan decisions. Comparison shopping should be easy. We are not affiliated with any one loan provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about loans. Our goal is to be an objective, third-party resource for everything loan related. We update our site regularly, and all content is reviewed by experts.

If you look at recent media coverage of higher education in the United States, you will immediately begin noticing a very widespread problem: our students are falling into unmanageable debt.

Some say this is due to the fact that our colleges cost too much money. Take a look at California, for example, which over the last 30 years has seen an average tuition spike of more than 1000 percent across its three public university types.

Others, however, blame this debt trend on financial education—or lack thereof.

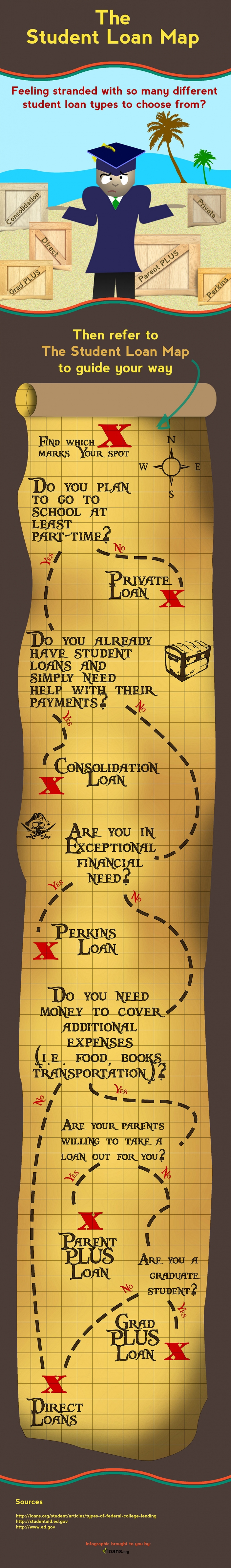

Most of our brand new adults of 18 years old are forced to take out student loans if they want to pay for a higher education. Few of these borrowers know about the intricacies of the loans they sign, and fewer still actually read the fine print of their contracts. Couple that with the fact that the government offers so many different types of loans (Perkins, Grad PLUS, Consolidation, Parent PLUS, and Direct loans), and it becomes difficult to expect any of these young adults to fully comprehend what they are getting themselves into.

To help combat that lack of education, loans.org has set out to make a simple guide surrounding federal student loans.

This infographic below is meant to accompany that guide and help students visualize exactly what kind of government-backed student loan is right for them (if any).

If you would like to share this infographic with your friends, family, readers, or students, please feel free to copy and paste the embed code found below.

To include this image on your website, copy the embed code below and add it to your website: