Back to the Future: The Cost of Mortgage Rates Present and Past

Apply for a Loan

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jun 29, 2022

Advertiser Disclosure: We strive to help you make confident loan decisions. Comparison shopping should be easy. We are not affiliated with any one loan provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about loans. Our goal is to be an objective, third-party resource for everything loan related. We update our site regularly, and all content is reviewed by experts.

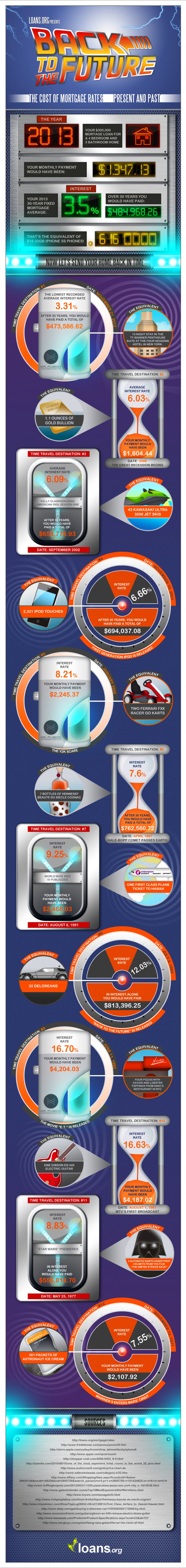

Mortgage rates have never been lower — but they most certainly have been higher!

This latest infographic takes mortgage loan rates back in time from the last decade, to the 90s and even back to the 80s! It turns out, you could have spent a lot more on your mortgage loan payments in the past than you could or would today.

We thought the best way to understand the savings that today’s mortgage loan interest rates brings is by comparing present day costs with the past’s.

Do you remember when Kelly Clarkson won American Idol Season One? It was in September of 2002, and 30-year home loan interest rates averaged 6.09 percent. This means that after 30 years, you would have paid a total of $653,776.93 on a $300,000 mortgage loan. That’s the equivalent of 43 Kawasaki Ultra 300X Jet Skis!

On August 6, 1991, the World Wide Web was first publicized. Interest rates stood at 9.25 percent. Your monthly payment would have $2,468.03 on a $300,000 mortgage loan. That could have bought you one first class plane ticket to Hawaii — every month!

On June 11, 1982, the film “E.T.” was released in theatres. Interest rates were a whopping 16.70 percent. Your monthly payment would have been $3,503.36. That could have bought you three-and-a-half pizzas with caviar and lobster toppings from Nino’s Restaurant in NYC.

Let’s come back to the future though, where mortgage rate trends continue to hover near historic low levels.

Scroll down to see the rest of the data for our “Back to the Future: The Cost of Mortgage Rates Past and Present” infographic.

If you would like to share this infographic with your friends, family or readers, please feel free to copy and paste the embed code found below.

To include this image on your website, copy the embed code below and add it to your website: