Looking At Borrowers: Who Borrows Personal Loans and Why

Apply for a Loan

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jun 29, 2022

Advertiser Disclosure: We strive to help you make confident loan decisions. Comparison shopping should be easy. We are not affiliated with any one loan provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about loans. Our goal is to be an objective, third-party resource for everything loan related. We update our site regularly, and all content is reviewed by experts.

What makes personal loan borrowers unique?

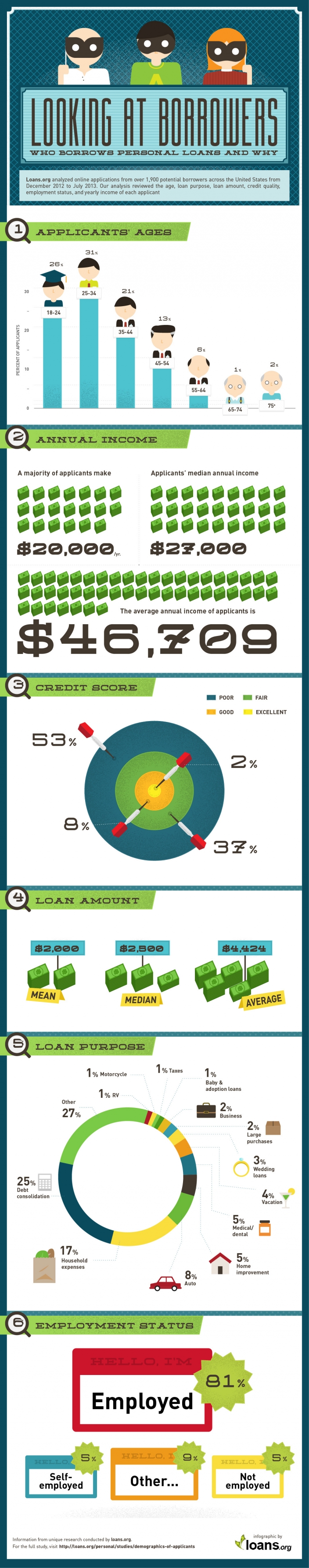

Small consumer loans are taken out daily across the country, but the identity of those borrowers is often stereotyped, assumed, and generally unknown. In a unique study from loans.org, demographics of personal loan applicants were analyzed.

Loans.org conducted research from over 1,900 personal loan applicants and reviewed their age, loan purpose, loan amount, credit quality, employment status, and yearly income. In the following infographic, this information is organized and reveals several unique findings.

One of the most significant finding from the research was the fact that over half of borrowers have poor credit scores.

Despite having low credit scores, almost all applicants have some form of employment, whether a regular employment opportunity (81 percent), self-employment opportunity (5 percent), or other (5 percent).

If you would like to share this infographic with your friends, family or readers, please feel free to copy and paste the embed code found below.

To include this image on your website, copy the embed code below and add it to your website: