10 Best States for COVID-19 Paycheck Protection Program Assistance (2025 Update)

The 2020 Paycheck Protection Program has allocated $517.3 billion to states across America with an average of $10.3 billion Paycheck Protection Program loan amount per state. California received the largest loan award amount with $68.2 billion. The PPP covered 49 million jobs in under three months — from its start in April until the end of June 2020.

Read more

Free Personal Loan Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Apr 3, 2025

Advertiser Disclosure: We strive to help you make confident loan decisions. Comparison shopping should be easy. We are not affiliated with any one loan provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about loans. Our goal is to be an objective, third-party resource for everything loan related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Apr 3, 2025

Advertiser Disclosure: We strive to help you make confident loan decisions. Comparison shopping should be easy. We are not affiliated with any one loan provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The average Paycheck Protection Program award amount per state is $10.3 billion

- The average unemployment rate for all states as of June 2020 is 10 percent

- The median salary for all states adjusted by cost of living is $35,137

- A total of 49 million jobs were covered in first-round PPP funding

With the economy in danger of collapsing due to the novel coronavirus, Congress stepped in to help small businesses. Enter the CARES Act, which created the Paycheck Protection Program (PPP). The Paycheck Protection Program allocated federal government dollars to small businesses across America.

It was a way of keeping small businesses alive while supporting their employees. But even though small businesses in all states were allowed to apply, some states received better award amounts than others.

We answer the question, “Which state received the best Paycheck Protection Program assistance?” in our study and rank the 10 best states for PPP assistance.

A gauge of this is to look at each state’s number of jobs covered under the PPP, which is represented in the graph above. It’s interactive. Just hover your cursor (desktop) or press your finger (mobile) to see the results in a particular state.

The number of PPP-covered jobs versus all jobs ranges from 11.5 percent to 47.3 percent. The median for all states is 28.4 percent. After our ranking, we’ll cover some of the major topics surrounding the Paycheck Protection Program, including:

- Are PPP funds still available?

- Can employees get PPP and unemployment?

- PPP rehire requirements

- Payment Protection Program lenders

- Paycheck Protection Program forgiveness

We know that these are difficult times, both financially and personally. You may have lost your job or are struggling with personal health, and it can feel overwhelming when the bills start stacking up.

A loan may be the answer you’re looking for. Searching for the best loans by state is a quick way to find the best lenders and the best loans in the area you live in. An even easier and quicker way is to compare multiple loan offers from different lenders at the same time.

Enter your ZIP code into our free online loan comparison tool to start comparing loans and finding the best loans and lenders for your financial situation.

Now, back to the Paycheck Protection Program. Check out our ranking by scrolling down.

10 Best States for Coronavirus PPP Assistance

Our 10 best states for coronavirus PPP assistance are scattered across the country. Some are on the East Coast, others on the West, and we even have one in the Pacific Ocean. On top of that, their populations and landmasses are all very different. So what do they have in common?

To create our ranking, we looked at a single statistic: how much the average PPP loan in a state made up of the state’s average salary. The average PPP loan percentage for all states makes up 28.9 percent of the average salary.

The average salary for all states was adjusted for the cost of living. Before we get into the ranking, we have four graphs that show four factors for the 10 best states:

- Jobs covered by the Paycheck Protection Program

- The state’s average salary

- The state’s average loan amount per job

- The five largest industries in the 10 best states

First, here’s a look at the number of jobs per state covered by the Paycheck Protection Program. Within our 10 best states, the number of jobs covered ranges from 100,000 to 3.2 million.

The state with the largest number of jobs is New York at 3.2 million. Two states share the spot for the smallest number of jobs covered: Delaware and Vermont at 100,000.

The next graph shows each 10 best state’s average salaries adjusted for the cost of living. As we’ll see in the sections below, the cost of living can reduce or raise a state’s average salary significantly.

The state with the highest average salary is Washington at $39,600. The state with the lowest average salary is Hawaii at $31,500. The following graph contains a statistic that is integral for our overall ranking: the loan amount per job.

Generally, if a state has a larger loan amount per job, its employees have received more assistance compared to states with a smaller loan amount. As you’ll see in the ranking, though, that is not always the case.

There are two aberrations to the assumption that a larger loan amount per job equals better assistance. The first is with Hawaii, which is ranked No. 3 in the overall ranking. It has a smaller loan amount per job than the No. 4 and No. 5 states.

The second is New Jersey, which is ranked No. 10. It has a larger loan amount per job than the No. 9 and the No. 8 states.

The larger loan amount per job doesn’t necessarily indicate which states are taking care of their workers the best. Other factors like average salary adjusted for cost of living play a role.

The final graph in this section looks at the top five industries for those 10 best states. To create this ranking, we looked at the three largest industries in all 10 states for 2018.

Apply for a loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

Then, we calculated the total revenue from those industries and ordered the list with the highest-revenue industry on top. In 2018, all industries generated $85 billion or more, while the largest industry made a little over $570 billion.

The top three industries are all spaced by at least $100 billion. The largest industry is real estate, which generated $572 billion in 2018. The next largest industry is professional and business services at $470 billion. The third-largest industry is finance and insurance at $344 billion.

Certain industries, regardless of revenue, received more Paycheck Protection Program assistance than others. The top 10 industries for Paycheck Protection Program assistance were awarded billions of dollars and sometimes hundreds of thousands of loans.

This was due, in part, because the small businesses in those industries were projected to lose up to $431 billion a month for every month the shelter-in-place orders were in effect.

Those graphs give a large-scale view of the best 10 states. The ranking is in descending order—the No. 10 ranked state at the top going all the way down to the No. 1 state. We’ll use further statistics to provide an analysis of how well the PPP is covering workers in those states.

Of course, there are more types of loans that business owners can apply for to help them get through the devastating effects of the coronavirus pandemic. Check out our business loans page for more information.

#10 – New Jersey

New Jersey, the Garden State, is our No. 10 state on this list. The following table shows five statistics: the number of jobs PPP covers in New Jersey, the total PPP loan amount to the state, the loan amount by the job, the average salary in Jersey adjusted by the cost of living, and how much the average PPP loan makes up of the average salary.

New Jersey Paycheck Protection Program Statistics| PPP Loan Amount | $17.2 billion |

|---|---|

| # of Jobs Covered | 1.5 million |

| Loan Amount by Job | $11,470 |

| Salary by Cost of Living | $35,276 |

| % of Loan Amount per Salary | 32.5% |

The PPP covers 1.5 million jobs in New Jersey, which is the second-highest of all states on this list. It also received the second-highest PPP award at $17.2 billion. You might think that this means that every covered job in New Jersey has a high PPP loan amount.

This is not the case. New Jersey has the third-lowest loan amount per job of the 10 best states. There are further problems, as the average salary in New Jersey is relatively high compared to other states in this ranking.

This means that the average PPP loan in New Jersey makes up 32.5 percent of the state’s average salary. This puts it at No. 10 on this list. Other than a PPP loan, residents of New Jersey have many options for loans depending on where they live. A loan in New Jersey may save a business in the long run, even if it doesn’t come from the PPP.

Apply for a loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

#9 – Maine

Maine, the Pine Tree State, comes in at No. 9 on this list. The following table shows those same five statistics we covered in New Jersey. As you’ll see, the amount the PPP awarded to Maine is much smaller than New Jersey’s. But the number of jobs being covered under the PPP is much smaller as well.

Maine Paycheck Protection Program Statistics| PPP Loan Amount | $2.2 billion |

|---|---|

| # of Jobs Covered | 200,000 |

| Loan Amount by Job | $11,210 |

| Salary by Cost of Living | $33,978 |

| % of Loan Amount per Salary | 33.0% |

Because Maine has just 200,000 jobs covered under the PPP, the overall loan amount given to small businesses in the Pine Tree State is much smaller than other states. The comparison between the two shows Maine has the second-lowest loan amount per job. But it also has one of the lowest average salaries in the 10 best states.

This means that its average loan amount in Maine goes further for its residents than those in New Jersey.

The average Paycheck Protection Program loan in Maine makes up 33 percent of the state’s average salary.

Maine ranks high out of all 50 states for PPP assistance, which is certainly good news. Finding a loan outside of the Paycheck Protection Program has never been simpler as well. There are hundreds of areas to find a loan in Maine, from smaller towns to cities.

#8 – New Mexico

New Mexico, The Land of Enchantment, comes in at No. 8 on this list. The statistics below for our five categories show almost identical numbers as Maine. But there is one large exception that separates New Mexico from the previous two states. This shows that workers in New Mexico are receiving better assistance.

New Mexico Paycheck Protection Program Statistics| PPP Loan Amount | $2.2 billion |

|---|---|

| # of Jobs Covered | 200,000 |

| Loan Amount by Job | $11,204 |

| Salary by Cost of Living | $33,217 |

| % of Loan Amount per Salary | 33.7% |

The first three statistics are almost the exact same compared to Maine. Only the loan amount per job is different — New Mexico’s average loan amount is $6 lower. The main difference is the average salary adjusted for cost of living.

The cost of living in New Mexico is $760 lower than the cost of living in Maine. This stretches the loan amount a little bit more, accounting for 33.7 percent of the average salary compared to 33 percent in Maine.

If you’re a small business owner and need more than the PPP loan to keep your business alive, you can find options for loans in New Mexico, depending on where you live.

Apply for a loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

#7 – Vermont

Vermont, the Green Mountain State, comes in at No. 7 on this list. The table below shows our five statistics: the number of jobs in Vermont covered by the PPP, the total loan amount awarded to Vermont, the loan amount per job, the salary adjusted for the cost of living, and the percentage the loan amount makes up of the state’s average salary.

Vermont Paycheck Protection Program Statistics| PPP Loan Amount | $1.2 billion |

|---|---|

| # of Jobs Covered | 100,000 |

| Loan Amount by Job | $11,874 |

| Salary by Cost of Living | $35,064 |

| % of Loan Amount per Salary | 33.9% |

Vermont is just one of two states with 100,000 jobs covered by the Paycheck Protection Program. This is the lowest number of jobs covered by a single state. In addition, the PPP loan amount awarded to Vermont is the lowest out of all 10 best states.

Although Vermont received the lowest award amount, because it has the lowest number of jobs covered, its loan amount per job is higher than the previous three states.

When factoring in Vermont’s average salary by the cost of living, the percentage of that salary made up by a PPP loan is higher than those previous three states as well: 33.9 percent, 1.4 percent higher than the lowest state on this list.

#6 – New York

New York, the Empire State, comes in at No. 6 on this list. The following table shows New York’s statistics for jobs covered by the PPP, the total loan amount given to New York, the loan amount per job, the salary by the cost of living, and the percentage of the salary covered by a PPP loan.

New York State Paycheck Protection Program Statistics| PPP Loan Amount | $38.4 billion |

|---|---|

| # of Jobs Covered | 3.2 million |

| Loan Amount by Job | $11,984 |

| Salary by Cost of Living | $35,061 |

| % of Loan Amount per Salary | 34.2% |

New York has the largest values in two of our five categories. It has the largest number of jobs covered under the Paycheck Protection Program and the highest total award amount out of our 10 best states. As we’ve seen, though, it’s the ratio of the loan amount per job that matters the most.

In this case, New York’s loan amount per job is ranked just sixth overall. New York’s average Paycheck Protection Program loan makes up 34.2 percent of the state’s average salary when that salary is adjusted for the cost of living. This is in the middle of the pack.

What’s interesting to note is that New York had one of the highest average salaries of all states and was just one of seven states that had an average salary of over $40,000. But when the cost of living was factored in, that average salary dropped a little over $5,000.

#5 – Virginia

Virginia, with its nickname of Old Dominion, comes in at No. 5 on this list. The table below shows its values for our five statistics that we’ve covered for each state so far.

Those are the number of jobs covered by the Paycheck Protection Program, the total loan amount awarded to Virginia, the average loan amount per job, Virginia’s salary by the cost of living, and the percentage of the average salary equivalent to the average PPP loan amount.

Virginia Paycheck Protection Program Statistics| PPP Loan Amount | $12.6 billion |

|---|---|

| # of Jobs Covered | 1 million |

| Loan Amount by Job | $12,611 |

| Salary by Cost of Living | $35,814 |

| % of Loan Amount per Salary | 35.2% |

Like with other states, we see a correlation between the absolute values of the number of jobs PPP covers and the total loan amount. Virginia has much fewer jobs covered under PPP than New York and has a much smaller total loan amount as well.

Virginia’s average loan amount per job is $600 higher than New York’s, even though the federal government allocated much less money to Virginia than New York.

This is because although Virginia received less money, fewer jobs in the state were covered. Combine that with Virginia’s average salary adjusted by cost of living, and Virginia’s percentage of salary made up by PPP loan amount is 35.2 percent.

While that’s a large number and better than 45 other states, business owners still might feel the strain in their personal pocketbooks even though their business continues to hang on. For this, a business owner can seek out a personal loan through numerous loan companies in Virginia to give them some peace of mind that their personal bills will be covered.

#4 – New Hampshire

New Hampshire, the Granite State, comes in at No. 4 on this list. The statistics below show New Hampshire’s values for the number of jobs covered by the PPP, the total loan award amount, the loan amount per job, the average salary by cost of living, and the percentage of salary that makes up the average PPP loan.

New Hampshire Paycheck Protection Program Statistics| PPP Loan Amount | $2.6 billion |

|---|---|

| # of Jobs Covered | 200,000 |

| Loan Amount by Job | $12,753 |

| Salary by Cost of Living | $33,710 |

| % of Loan Amount per Salary | 37.8% |

New Hampshire is quite the opposite of the last two states we’ve covered. It has just 200,000 jobs covered under PPP, which is tied for the second-lowest total of our 10 best states. Its $2.6 billion award from the PPP is lumped in with numerous other states who received total loan awards between $1 billion and $3 billion.

New Hampshire’s average loan amount is $12,500, the third-highest for all states. New Hampshire’s average salary adjusted by the cost of living is $33,700. This is what drops it to the No. 4 spot. The combination of these statistics means that the average PPP loan amount makes up 37.8 percent of the average salary.

Sometimes, however, PPP loans are not enough and you need an additional loan to keep your business afloat or pay your personal bills. There are a plentiful number of loan companies in New Hampshire where you can get loans, including personal and business loans.

#3 – Hawaii

Hawaii, the Aloha State, comes in at No. 3 on this list. Hawaii has nearly identical statistics for the number of jobs covered and the overall award amount.

In addition to those two statistics, the table below shows the average loan amount per job in Hawaii, the average salary by the cost of living, and the percentage that the average PPP loan makes up of the state’s average salary.

Hawaii Paycheck Protection Program Statistics| PPP Loan Amount | $2.5 billion |

|---|---|

| # of Jobs Covered | 200,000 |

| Loan Amount by Job | $12,489 |

| Salary by Cost of Living | $31,493 |

| % of Loan Amount per Salary | 39.7% |

Hawaii actually has a lower loan amount per job than New Hampshire by around $250. But because the average salary in Hawaii is $2,200 less than in New Hampshire, the percentage of salary made up by the average PPP loan amount is higher.

In Hawaii, if you missed out on the PPP funding round, you can secure loans in dozens of areas including Honolulu. Getting a loan in Hawaii can make the difference between success and failure and, most importantly, keep a person from going bankrupt.

Apply for a loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

#2 – Delaware

Delaware, the First State, comes in at No. 2 on this list. Out of our 10 best states, Delaware is the state with the first big jump in overall statistics compared to the previous eight states.

The table shows those same five statistics: the number of jobs in Delaware covered under the PPP, total award amount, the average loan amount per job, average salary by the cost of living, and percentage of salary equivalent to the average PPP loan amount.

Delaware Paycheck Protection Program Statistics| PPP Loan Amount | $1.5 billion |

|---|---|

| # of Jobs Covered | 100,000 |

| Loan Amount by Job | $14,897 |

| Salary by Cost of Living | $36,481 |

| % of Loan Amount per Salary | 40.8% |

Delaware has the second-lowest award amount out of all 10 states and a small number of jobs covered under the PPP. Because of the ratio of those two numbers, Delaware easily has the second-highest loan amount per job.

The fact that it has the second-highest salary by the cost of living brings it down a little. That makes the percentage of its average salary equivalent to the average PPP loan value 40.8 percent or just 1.2 percent above Hawaii.

While the PPP loans are necessary for some small businesses to survive, they face additional challenges as shelter-in-place orders end and economies continue to open up.

A big fear of small business owners is that they might be held liable if an employee or customer catches the coronavirus while in their shop or on their property.

Fortunately, there is an easy way for employees to check if they have the coronavirus before returning to work. That way is a coronavirus test. Some health insurance companies cover coronavirus testing. Call your insurance company to find out more.

#1 – Washington

Washington, the Evergreen State, comes in at No. 1 on this list. How does it fare compared to other states?

The following table shows the number of jobs covered under the PPP in the state, the overall loan amount, the loan amount per job, the salary adjusted by cost of living, and the percentage of the average loan amount per job makes up of the average salary.

You’ll see big jumps in the statistics that matter the most: loan amount per job and percentage the average loan amount makes up of average salary. In addition, the amount of money it received compared to the number of jobs is much higher than for other states.

Washington State Paycheck Protection Program Statistics| PPP Loan Amount | $12.3 billion |

|---|---|

| # of Jobs Covered | 500,000 |

| Loan Amount by Job | $24,604 |

| Salary by Cost of Living | $39,641 |

| % of Loan Amount per Salary | 62.1% |

As of the end of June 2020, Washington has received $12.3 billion in loans for its small businesses. The number of jobs covered in Washington is around 500,000 jobs. In comparison, Washington exceeds all other states for average loan amount per job.

To get a closer look, we’ll analyze Washington’s statistics compared to the three states that have more jobs covered under the PPP: Virginia, New York, and New Jersey. The following table shows the number of jobs and total loan award amount covered through the PPP for Washington, Virginia, New York, and New Jersey.

In the final column at the far right, those award amounts are what Washington’s award would be if it had the number of workers covered under the PPP in Virginia, New York, and New Jersey.

Washington PPP Loan Stats Compared to VA, NJ, & NY| Rank | State | Jobs Covered | Amount Awarded (Billions) | WA Amount if Same Job Total (Billions) |

|---|---|---|---|---|

| 1 | Washington | 500,000 | $12.3 | $12.3 |

| 5 | Virginia | 1 million | $12.6 | $24.6 |

| 6 | New York | 3.2 million | $38.4 | $64.0 |

| 10 | New Jersey | 1.5 million | $17.2 | $36.9 |

Washington’s award amount if it had the number of jobs covered compared to those three states beats all of them by at least $12 billion.

In addition, Washington’s $24,604 loan amount per job is $9,700 higher than Delaware’s. Its PPP loan percentage out of the average salary is 62.1 percent, 21 percent higher than Delaware, the second-place finisher.

However, that doesn’t mean all small business owners fared well in securing a PPP loan. Later, officials and organizations analyzing the PPP program noted that some business owners were left out either due to pre-existing relationships other business owners had with banks or other issues.

For these business owners, finding a new loan might be the only way to prevent their business from going under. Fortunately, it is possible to secure a loan in Washington separate from the PPP program. This can keep businesses afloat while protecting an owner from bankruptcy.

Some businesses, unfortunately, suffered damage during riots back in early 2020 and are fighting with business insurance companies for reimbursements due to damages. Commercial insurance can cover riots and other more niche issues, but you must look at your business plan to be sure.

Apply for a Loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

50 State Comparison: Coronavirus Paycheck Protection Program

So we’ve covered the 10 best states for coronavirus PPP assistance. In this section, we’re going to look a little broader, moving from 10 states to all 50 states in America. Because the statistics are so detailed, we’ve compiled four interactive charts that allow you to search for your own state easily and quickly.

These charts cover three statistics we’ve seen before:

- Paycheck Protection Program approval amount per job by state

- State average salary by cost of living

- Percentage of state average loan amount out of the state’s average salary

The first chart shows the PPP approval amount per job by state. Unlike the previous chart, these statistics are shown in bar charts, with the states organized according to region. Click on a specific tab at the top of the graph to see states in that region.

There are just 18 states above the average loan per job amount for all states. This, again, points to the difference between the loans each state is receiving. There is a cluster of states that are receiving PPP loan awards per job far above the other states.

With this graph, the region with the most states above the average PPP loan per job is in the Northeast. The second region is the West, while the South and the Midwest make up third and fourth spots, respectively. The average PPP award for all states is $10.3 billion, while the median PPP award value is $6.4 billion.

The next chart shows the average salary in all 50 states adjusted for cost of living. This one is a countrywide map. If you’re on a desktop computer, hover your cursor over a particular state to see the average salary in that state. Or if you’re on mobile, press your finger down on a state to see its statistics.

As you can see, there are only two states where the average salary by the cost of living is over $40,000. The average salary by the cost of living for all states is just $34,500. That number jumps by $900 when the cost of living isn’t factored in.

The average salary for all states then becomes $35,400. The median salary jumps as well from $33,600 to $35,100. The states that had the biggest rise when factoring in the cost of living were predominantly Southern or Midwestern states. The biggest rise was in Mississippi at $4,445. The state with the biggest drop was New York at -$5,339.

The next chart shows the statistic that determined our ranking: the percentage of the loan amount that makes up the average salary adjusted by the cost of living.

Between the 50 states, there was a wide disparity between the states with the highest percentages and those with the lowest. We’ve already seen that Washington state had the highest percentage at 62.1 percent. The lowest was 43 percent less than Washington — Utah at 19.1 percent. The median for all states was 27.8 percent.

Twenty-seven states are between 24 percent and 29 percent. While the graph may seem even, the majority of the states at the lower end of the spectrum are rural states, whether in the Midwest or the South. States with more urban populations are higher in the list.

Of course, there were controversies in the rollout of Paycheck Protection Program loans. Male business owners overall fared better than female business owners for Paycheck Protection Program assistance, receiving more loans and a higher average loan amount overall.

Apply for a loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

In some states, female business owners outperformed male business owners, however, even when receiving smaller loan amounts on average.

The Coronavirus Pandemic’s Economic Impact

When the novel coronavirus reached the United States in February 2020, Americans watched as it spread from coast to coast, shocking the nation as it had for other countries in the world. At first, community leaders tried to maintain a sense of calm even as the pandemic spread.

Some mayors and governors had tried to keep cities and states open for a time to keep the economy going, in spite of the rising number of cases, hospitalizations, and deaths.

Soon, however, states were shut down, people kept in their houses, with economies grinding to a halt. Small businesses were caught in the mix: They needed to pay their employees and rent for their buildings. But without their customers, they were generating little to no revenue.

Soon, statistics came in that showed the devastation that the coronavirus had on the economy. What happened, now that the economic damage has become clearer?

- Over 30 million U.S. residents were receiving unemployment benefits in early May.

- The travel industry was decimated, which included travel agents and small travel agencies.

- Small businesses were faced with huge bills and no revenue.

Soon, the U.S. Congress passed the CARES Act, which provided Americans with a great deal of financial relief. Things looked less bleak, and soon governors were reopening their states to revive dormant or struggling economies.

But in that time between the shutting down of cities and states to the reopening, some industries have been hit harder than others and face a long road to recovery, if they will make it there at all. The industries most affected in most cases have been ones relying on in-person customers. These include restaurants, retail stores, and the travel industry.

Millions of American workers still need jobs and money even two months after the opening of economies throughout the country.

Workers and small businesses face a unique struggle, which the federal government has noticed and attempted to provide aid. Time will tell what the American economy will look like after all of this. It is unlikely, if not impossible, for things to go back to the way they were before.

Apply for a loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

Next Steps for COVID-19 Economic Recovery

Congress is in the process of drafting a bill to provide more relief to businesses and workers. Another stimulus check is possible, and more help for small businesses and corporations seems on the way.

Some industries have come out looking good in this pandemic. Internet video conferencing companies like Zoom have seen their revenue shoot through the roof. Online content distributors like Netflix, Hulu, and Amazon Prime have seen their new customer signups grow dramatically with people forced to remain home.

Apply for a loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

While many small businesses will be looking to the PPP loans for assistance, it is possible that any business-to-consumer companies that rely on in-person sales will continue to struggle. Our buying preferences have shifted from in-person shopping to online purchasing of products, which could affect retail stores even as economies reopen.

Many people have even shifted over to grocery delivery rather than enter a grocery store. Shopping malls may be barren or forced to close in the coming months or years. Time will tell how this all plays out and how many small businesses survive this time period, what industries will take the longest to recover, and which workers have to switch over to another job or occupation.

Some industries have taken advantage of PPP loans more than others, using Paycheck Protection Program rules and Paycheck Protection Program updates to secure loans while also applying for loan forgiveness. So who qualifies for the Paycheck Protection Program? It’s important to note that PPP loans are not just for small business owners but also for self-employed workers who can also fill out a PPP loan application.

The Paycheck Protection Program for self-employed workers is an unprecedented step in viewing individuals who are self-employed similar to a small business owner who relies solely on themselves for income.

What does the Paycheck Protection Program cover? A PPP loan for self-employed workers follows the same rules as those for small business owners, including the ability to use part of the money for monthly rent, mortgage payments, or utility bills. It remains to be seen how many self-employed workers a person will find on a list of Paycheck Protection Program recipients, including a list of PPP loan recipients by state.

But it is a step in the right direction and can save self-employed workers from financial catastrophe. There are some people — perhaps bold — that are trying to start businesses during this pandemic as well. While it may be a challenge for these individuals to secure a business loan if unemployed, it’s not impossible.

Many of today’s great companies were founded during the last economic crisis called the “Great Recession.” Perhaps in a few years, we’ll see new, major companies started during this period of acute economic distress.

Apply for a Loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

PPP Discussion: Financial Relief, Hidden Dangers, & Fraud

We’ve covered our 10 best states for the Paycheck Protection Program and briefly looked at how the PPP has affected all states. Now, we’re going to spotlight four expert opinions about the PPP and how it affects small businesses.

Of these experts, two are small business owners, one is a financial consultant, and the other a lawyer. Together, they cover everything from the difficulties facing small businesses and the tricky nature of selecting a loan to the possible fraud investigations.

First, we interviewed a former employee of the Small Business Administration who has been consulting a number of organizations and companies on Paycheck Protection Program loans.

Check out his expert advice below.

What are the benefits or risks of accepting a Paycheck Protection Program loan?

“The great benefit of the PPP loan is that it’s a very low-interest loan and if used correctly, a loan that doesn’t have to be repaid. It’s meant to subsidize things like payroll, certain benefits, business mortgage interest, business rent, and business utilities for a period of time.

The greatest risk is if you’re 100 percent dependent on the loan forgiveness and don’t meet that, you’ll have to repay part of the loan at a very low 1 percent interest rate within two years.”

Are there any hidden dangers of accepting a loan?

“Certain aspects of the loan are tricky. Only certain types of benefits are covered and it depends on how your company was incorporated. This is especially true for employer contributions to health care and retirement plans.

There are also some stipulations around paid leave and sick leave. The biggest danger is if you don’t rehire your employees or reduce their salary to lower than 25 percent of what they made before the pandemic hit, as that triggers a formula that may reduce the amount forgiven.”

Why would you accept or not accept a PPP loan for your business?

“If you feel confident that you can utilize the loan primarily for payroll expenses (and other allowable expenses) in the coverage period, it’s a good idea to get the loan, as that money will be forgiven and give you some cash to bridge expenses.

If you can’t afford to pay back at least part of the loan should you not use it for forgivable expenses, I wouldn’t recommend taking it.

It may be considered fraud if you apply for the PPP loan knowing that you’re going to use the funds for non-forgivable expenses, so stay clear of the loan if you have other plans for it besides the forgivable expenses.”

Do you think the Paycheck Protection Program is doing enough for small businesses?

“I think more needs to be done for small businesses. These loans were meant to hold over small businesses for essentially two months but the pandemic is clearly lasting longer, and small businesses face a lot of uncertainty, including potential shutdowns.

We need to help our small businesses survive these times in order to get our jobs numbers back up after the pandemic is over. Small businesses employ as much as 50 percent of the country’s workforce. I fear many small businesses, without additional help, will go under and our economic recovery will be much slower.”

Do you think businesses are getting PPP loans that shouldn’t be?

“There are probably a few bad actors that are getting PPP loans that don’t need them. The hope is that these are the exception and not the rule.”

Chris has over 13 years of experience in public policy, politics, and business management.

“I own a company located in the San Francisco Bay Area that sells office headsets.

I applied to the SBA Paycheck Protection Program (PPP) for my business in July of 2020 when it was first announced. The loan process was simple enough; I just needed to send in some paperwork.

It was quickly approved by my bank we have our business checking account with. In order to qualify for PPP, I had to submit the following:

- Our company’s payroll tax return (Form 941) for the last quarter

- 2019 business income tax return

- 2019 profit and loss statement

- Evidence of employee health insurance coverage

Obviously, you have to show that you’re a real business and have evidence of employees on your payroll. When my bank received the applications, the funds were quickly processed and received with a week of approval.

Given that COVID-19 is not going away any time soon, I do expect another round of assistance programs will get approved by Congress.

If more assistance isn’t provided, many small businesses like mine will go under and most employees will be laid off.

The first PPP loan was designed to help us for only three months. We’re staying afloat by the skin of our teeth. Going forward, without further funding or another round of PPP assistance, we will have to lay off many of our existing staff and move to a smaller office and warehouse.

We might even have to close our business if we cannot generate enough income to stay in business for the next few months. Most of what the PPP provided for us is already used up.”

Commonly Asked Questions for Businesses Filing for PPP

What steps have you had to take to pay your employees during the coronavirus pandemic?

“Personally, I had to apply for PPP and secure other funding.”

Have you had to reduce salaries, restrict hours, or employ other mechanisms to keep your business afloat?

“We have reduced employee hours and had to reduce staff, unfortunately.”

How has the Paycheck Protection Program helped your company?

“Our PPP funds are running out. It will only help us for about two months.”

What was the process of applying for the Paycheck Protection Program? Were there any qualifications you had to meet or expectations that came with the loan?

“I went through my bank where I have my business account. To qualify, I had to submit last quarter’s payroll tax return (Form 941), 2019 Income Tax, 2019 Profit and Loss Statement, and evidence of employee health insurance coverage.”

Do you anticipate another round of funding for the Paycheck Protection Program with the second stimulus package being debated in Congress right now?

“I expect another round would get approved by Congress very shortly. Otherwise, many businesses will go under since COVID-19 is not going away anytime soon.”

If there is, will you seek another loan?

“Yes, in order to stay afloat.”

How will you handle payroll moving forward?

“One payroll at a time, until funds run out.”

Will you be forced to lower payroll for a longer period of time or do other things to reduce the burden of payroll in your company?

“If we don’t receive any more funding or help from the government, we will have to further reduce our number of employees and maybe even shut down our business entirely.”

His company, founded in 2003, sells headsets for office use.

“When PPP was introduced, I was actually very hesitant at first on the Payroll Protection Program. I run a financial consultant business and when my very first client was inquiring about the loan, I came up with about five scenarios on why it wouldn’t work or how it would affect them.

I called them numerous times going back between taking and not taking it. Since then, more and more information has come out and SBA updated their rules and regulations.

I actually believe that PPP is one of the best things that could have become available for your business.

Of course, I think there is an exception to every rule and if you have not been running your business for a while even prior to COVID-19 closures or you plan to use the funds for personal reasons then I don’t advise you to take it.

The funds are strictly meant to be used toward payroll, rent, and utilities, but the new law will allow borrowers to expand past just utilities and include software, legal fees, and professional fees as well. Also, if you run a business that has offshore employees, then your business does not qualify either.

For businesses that were closed for a certain period of time even though they did have some savings, you still qualify and should apply. The funds are meant to help you not only during COVID-19 closure but also for when you reopen.

Your business will not be the same for a while and there is always the possibility of closing again in the fall. So if your business qualifies and you plan to use the funds for valid expenses, I highly urge you to take it.

Since PPP is meant for businesses that have employees, many landlords do not qualify since they do not have any staff. Commercial tenants have been getting creative and working out deals with their landlords. These tenants are trying to use their approved PPP funds into getting a reduced rent for the three to four months they were closed.

They are also trying to use the funds to pay ahead for future months. This way the business owner can use the credit and the landlord can also get paid and not lose tenants.”

E & S Group provides personalized financial and HR consulting services.

What are the types of COVID-19 paycheck protection programs?

There are a number of different types of COVID-19 paycheck protection programs available to workers in the United States. Some programs protect only your first paycheck, while others protect all of your wages for a specified period of time.

Some of the best COVID-19 paycheck protection programs are those that protect your first paycheck, as this is the most important paycheck you will receive during this time.

If you are eligible for a COVID-19 paycheck protection program, make sure to sign up immediately. The longer you wait, the harder it will be to get assistance.

How to Apply for COVID-19 Paycheck Protection Program Assistance

If you are affected by the COVID-19 pandemic, and your wages have been reduced because of your illness, you may be eligible for assistance through the COVID-19 Paycheck Protection Program.

To apply for assistance, you need first to contact your employer. They will then need to provide documentation proving that your wages have been reduced due to the COVID-19 pandemic.

You can also apply for assistance through the COVID-19 website. However, this is only available in English.

If you are eligible for assistance, the government will pay your lost wages and provide other financial support. Depending on your situation, this could include money for food, housing, or transportation.

Why should you consider using a COVID-19 paycheck protection program?

Paycheck protection is a valuable tool that can help to protect your money in the event of unexpected financial hardship. Many states offer different types of benefits through their COVID-19 programs, and each offers its own set of advantages and restrictions.

It is important to choose the right program for you, and you should consult with a financial advisor to help you decide which program is best for your specific financial situation.

Some of the most common benefits offered through COVID-19 programs include payment protection, lost wages, missed payments, and other expenses related to bankruptcy or foreclosure. Income protection also protects you from experiencing a decrease in your income due to illness or unemployment.

There are many different COVID-19 programs available across the United States, so it is important to do your research before making a decision.”

Emma Collins is the co-founder of Safe Trade Binary Options.

Her company provides guides on crypto and trading.

What are the benefits or risks of accepting a Paycheck Protection Program loan?

“A Paycheck Protection Program (PPP) is a loan offered by a payday loan or installment loan provider in order to help you cover unexpected expenses that may arise while you are still receiving wages, such as medical expenses, car repairs, or unexpected rent.

The benefits of accepting a PPP loan may include the following:

- The ability to cover unexpected expenses without resorting to high-interest payday loans or pawnshop loans.

- The assurance of quick and easy access to funds in case of an emergency.

- Reduced stress and anxiety related to money matters.

There are some risks associated with taking out a PPP loan, including the following:

- The possibility that you will not be able to repay the loan fully on time.

- Interest rates can be high, particularly if you take out a large amount of money at once.

Ultimately the risks and benefits change from business to business, as an owner who is thinking about getting a PPP loan, it is vital that you do your research before committing to taking out a loan of this magnitude.”

Why would you accept or not accept a PPP loan for your business?

“PPP loans are a type of loan that businesses can use to help them cover unexpected expenses. By accepting a PPP loan, you agree to have the lender provide you with a loan in exchange for a share of your company’s future profits.

The ability to get cash quickly and easily, the security of knowing the loan will be repaid in full and on time and a potentially reduced interest rate compared to other forms of financing are all possible benefits of accepting a PPP loan for your business.”

Do you think businesses are getting PPP loans that shouldn’t be?

“There have been a lot of discussions recently around COVID-19 and the loans that businesses are receiving. While it is still early in the COVID–19 pandemic, some have raised concerns that some companies may receive PPP loans that shouldn’t.

PPP loans are typically given to businesses with good credit and a track record of being able to repay them.

However, during the early stages of a pandemic, many businesses may not be able to generate revenue or attract customers due to fears about the disease. This could make it difficult for these companies to repay their PPP loan, even if they have good credit and a history of paying debts.

It is important for businesses to receive PPP loans only if they genuinely need them. If there are doubts about whether a business can repay its loan, it is probably best not to get one.”

Vlad Mishkin is the founder of WebScraping.Ai.

His company solves web scraping issues at scale.

“Paycheck Protection Program & Loan Frauds Emerging from the COVID-19 Pandemic”

The Paycheck Protection Program (PPP) was created to provide much-needed financial relief to small and medium-sized businesses that are facing financial strain due to the COVID-19 crisis. Any time a federal program offers financial relief to businesses or consumers, there are going to be questions raised about fraud.

But, with the nature of the PPP and the extraordinary rate at which its multi-hundred-billion-dollar allocation was depleted, many companies that received PPP loans can expect to face heavy scrutiny from federal authorities.

What constitutes Paycheck Protection Program loan fraud?

As with all types of federal programs, there are various acts and omissions that have the potential to lead to allegations of federal fraud in relation to the PPP.

This includes not only intentional misrepresentations that can lead to criminal fraud charges. Fraud allegations also include inadvertent mistakes that still resulted in the improper receipt of federal funds.

Here are several loan fraud trends, spurring from the Paycheck Protection Program:

- Loan “stacking”: receiving funds from more than one lender

- PPP loan application fraud: misrepresenting information on the application. The information could be anything from the number of employees to payroll costs and more.

- Using PPP funds for ineligible business purposes: There are four purposes for the loan — payroll, mortgage interest, rent, and utilities. If used elsewhere it is impermissible.

- Using PPP funds for fraudulent purposes

- Fraudulent loan forgiveness certification

- Misrepresenting or concealing information during a PPP audit or investigation

What should you do if you or your company is targeted for Paycheck Protection Program loan fraud?

If you or your business is targeted in a PPP loan fraud audit or investigation, the single most important thing you can do is to engage in an experienced federal defense counsel right away. This is a serious matter that requires your immediate attention.”

He is a nationally recognized expert on Paycheck Protection Program laws.

Frequently Asked Questions: Specifics on Paycheck Protection Program Loans

We’ve covered the Paycheck Protection Program, the 10 best states for PPP assistance, and how the PPP has impacted all 50 states. Now, we’ll jump into a few of your frequently asked questions about the Paycheck Protection Program that you may have had as a small business owner, independent contractor, or self-employed worker.

These questions include:

- What can Paycheck Protection funds be used for?

- How can I get my PPP forgiven?

- Can employees get PPP and unemployment?

We’ll also go over the Paycheck Protection Program application, the Paycheck Protection Program in 2021, the Paycheck Protection Program for self-employed individuals, and review the Paycheck Protection Program (CARES Act) again as there have been Paycheck Protection Program extensions, which open the door for new Paycheck Protection Program recipients. Read on for answers to your Paycheck Protection Program search.

#1 – How do you qualify for the Paycheck Protection Program?

You must retain the average monthly number of full-time employees or more than the average monthly number of full-time equivalent employees than you have for the past year.

In addition, you must use 75 percent of your PPP loan on payroll. If you receive a loan but do not meet these requirements, the percentage of your loan that can be forgiven might change.

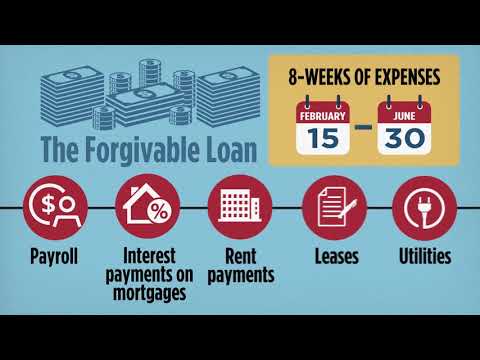

#2 – What can Paycheck Protection funds be used for?

While a small business owner must use 75 percent of the loan on payroll, they may also use the loan to help pay for interest on mortgages, rent payments, or utility payments. It is important to note that a “small business owner” may also be an independent contractor or self-employed individual.

#3 – What banks have the Paycheck Protection Program?

There are at least 30 banks that will accept applications for a PPP loan. These include heavyweights like Bank of America, Chase, and Capital One, and smaller banks like Regions and Seattle Bank.

According to the U.S. Treasury as well, banks are not the only qualified lenders. Others include credit unions, fintech, farm credit lenders, and microlenders.

#4 – Where can I get a check protection loan?

As noted above, there are numerous places a small business owner, independent contractor, or self-employed individual can apply for a PPP loan or check protection loan. These include standard banks, credit unions, farm credit lenders, microlenders, and business and industrial development companies. The largest lender at the end of June was JP Morgan Chase Bank.

#5 – How can I get my PPP forgiven?

There are a couple of ways. The first is to comply with the requirements of the loan, such as using 75 percent of the loan for payroll and making sure to keep the number of full-time employees or more than the average number of full-time equivalent employees on your payroll.

If you’ve already laid off your employees, you can use the PPP loan to rehire them, which can also count toward having your loan forgiven.

#6 – How do I know if my PPP loan is approved?

The way you can find out if your PPP loan is approved depends on the bank, other types of lender, or organization you submitted your application through. Each company or organization will have its own process.

Often, you can check on the status of your application online. In other cases, you can call the bank or organization or talk to someone in person, if the bank is open in your area.

#7 – Are PPP loans still available?

As of the end of June, PPP loans were still available, but the amounts have been reduced since the start of the program. Small businesses have been lobbying Congress for more small business assistance as it puts together its second stimulus package. Part of the reason is that the PPP was intended to cover two months.

However, state and city economies have struggled to reopen with the surge in coronavirus cases. For this reason, small businesses are still in danger of going bankrupt, and many more might do so if they don’t receive any further government aid.

#8 – Can employees get PPP and unemployment?

The quick answer is no. If an employee or someone who is self-employed decides to take out a loan through PPP, they cannot receive unemployment benefits. There is a difference in how much you can receive through each and which one might be the better fit for you.

While you might be able to receive more through a PPP loan (which allows for an award amount 2.5 times your average monthly earnings), unemployment might get you more in the long term with the $600 boost that came as part of the CARES Act.

There is another key difference: if you’re on PPP, you can continue to receive health insurance through your employer. If you’re on unemployment benefits, you can’t receive that insurance. Which you go with depends on your personal situation.

#9 – What are the PPP rehire requirements?

The general rule in PPP is that a small business owner has to use 75 percent of the loan on the payroll. This gets a little complicated if a small business owner needs to lay off employees or has done so before receiving the PPP loan.

Even still, the rules encourage a small business owner to rehire their employees, even if it’s toward the end of the loan period. The rules do this by mandating that a small business owner retains the same number of employees during one of the reference periods.

A small business owner can meet these requirements by rehiring employees or even hiring new ones. The goal behind the loan, first and foremost, is to pay employees and that’s a key requirement in getting the full amount of the loan forgiven.

#10 – Can 100 percent of a PPP loan be used for payroll?

Although a business owner must use at least 75 percent of their Paycheck Protection Program loan on payroll, there is no upper limit to this, meaning that a business owner can use 100 percent of their PPP loan on payroll and still have the loan forgiven.

#11 – What documents are needed for PPP loan forgiveness?

While there are different types of Paycheck Protection Program loan forgiveness applications, many of the required documents overlap between the two.

The documents typically needed for PPP loan forgiveness include bank statements that show how you used the PPP loan, the number of employees you had at the time you applied for the PPP loan and their salaries, identifying information of your business (business TIN, for instance), and any documentation of mortgage payments or any other use of the PPP loan other than for payroll.

#12 – How does the Paycheck Protection Program work?

The Paycheck Protection Program is a program created by the federal government to allow business owners (small business owners in particular) to pay for their employees’ salaries while their business was shut down during the coronavirus pandemic. To get a loan, a business owner must contact a bank and fill out the necessary forms. The loans are 100% forgivable if the owner uses the loan according to certain conditions.

#13 – Can I get a PPP loan if I opened my business in 2021?

Currently, only businesses that were in operation as of February 15, 2020, are eligible to receive PPP loans.

#14 – Can an LLC get a PPP loan?

Yes, owners of LLCs can receive loans as well as independent contractors and self-employed individuals.

#15 – Can a new company get a PPP loan?

For a company to be eligible to receive a PPP loan, they must have been in operation on or before February 15, 2020.

Methodology: Federal Statistics to Analyze CARES Act Impact

For this study, we analyzed data from four sources:

- U.S. Department of the Treasury

- U.S. Bureau of Labor Statistics

- Bureau of Economic Analysis

- Rasmussen College

The specific data we collected was the number of jobs covered in each state under the Paycheck Protection Act, the total size of the PPP award for that state, the average salary for that state, and the average salary for that state adjusted for the cost of living.

With that data, we created two additional statistics: the loan amount per job and the percentage the loan amount per job made up of the state’s average salary adjusted by cost of living

The higher the percentage, the more of their lost income was covered. The 10 best states were a mix of small and large states, urban versus more rural. In general, however, rural states were toward the bottom of the list, while more urban states were at the top.

This study, in some ways, was an analysis of the Paycheck Protection Program part of the CARES Act. We saw which states were receiving more or less money on average compared to the salary of the average worker in those states.

Whether you are a business owner, an employee, or someone who is unemployed, these are difficult economic and financial times. A loan might be the way to help you through, covering your bills and keeping you financially afloat.

Plug your ZIP code into our free online loan generator to find the best lenders in your area with the best loans personalized for your situation.

Apply for a Loan

Enter your ZIP code below to view lenders with cheap loan rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about loans. Our goal is to be an objective, third-party resource for everything loan related. We update our site regularly, and all content is reviewed by experts.