The History of the American Mortgage Loan

Apply for a Loan

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jul 18, 2021

Advertiser Disclosure: We strive to help you make confident loan decisions. Comparison shopping should be easy. We are not affiliated with any one loan provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about loans. Our goal is to be an objective, third-party resource for everything loan related. We update our site regularly, and all content is reviewed by experts.

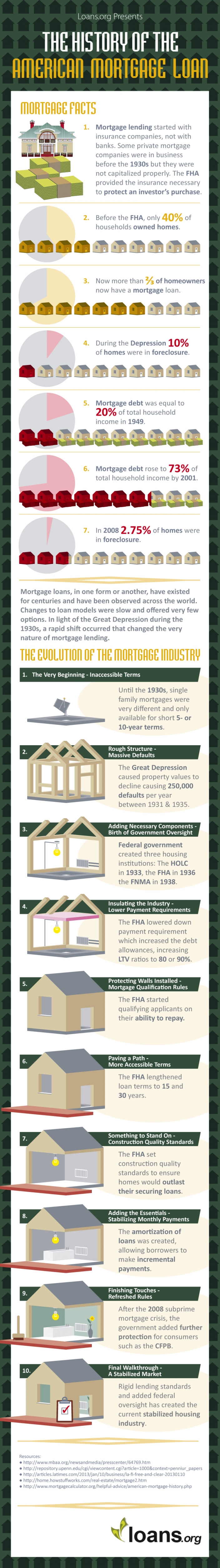

In the past century, the housing economy has shifted dramatically.

Mortgage lending used to be an unsecured investment so it was unavailable to a majority of borrowers. With the advent of the Federal Housing Administration (FHA) in 1936, as well as FNMA (which later became Fannie Mae) and the HOLC and in similar years, the housing market expanded.

But the change did not occur overnight. Similar to the many steps required to build a home, creating a stable mortgage lending industry took time.

When a contractor builds a home, the foundation must be present. Similarly, in order to stabilize the market, loan terms needed to be lengthened. Mortgage lenders used to offer loans for extremely short repayment period, such as five and 10 years. These were later expanded to 15- and 30-year terms, increasing the buying potential for each homeowner.

Years later, the FHA enacted rules to protect both the borrower and the lender. Just as a home needs protecting walls, similar lending protections ensuring that a borrower could repay the mortgage loan debt, were passed.

Other important steps such as the amortization of loans, construction standards and creating the CFPB helped to transform the mortgage loan industry into the complex and protected industry that it is today.

If you would like to share this infographic with your friends, family or readers, please feel free to copy and paste the embed code found below.

To include this image on your website, copy the embed code below and add it to your website: