Imagine If Everything Were Priced Like a Payday Loan

Apply for a Loan

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Founder, CFP®

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He also has an MBA from the University of South Florida. ...

Founder, CFP®

UPDATED: Jul 18, 2021

Advertiser Disclosure: We strive to help you make confident loan decisions. Comparison shopping should be easy. We are not affiliated with any one loan provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about loans. Our goal is to be an objective, third-party resource for everything loan related. We update our site regularly, and all content is reviewed by experts.

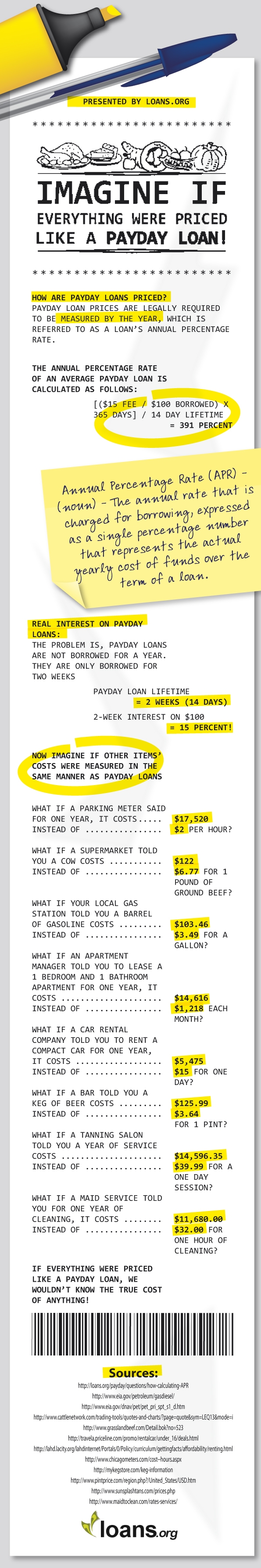

The law requires payday loan costs to be expressed in yearly terms, even though they only have average lifetimes of two weeks. This yearly cost is referred to as a payday loan’s annual percentage rate, or APR.

By forcing lenders to price payday loans based on their APR, consumers looking to borrow a payday loan often have trouble accurately understanding how much interest they will really pay after a normal 14-day term.

If everything were priced like payday loans, everyone would have difficulty finding out the true cost of anything.

For instance, imagine if you tried to park your car and the parking meter said it would cost you $17,520 to park for one year instead of saying it would be $2 per hour.

Or what if a gas station told you that a barrel of gasoline costs $103.46 instead of $3.49 for one gallon?

How could you budget yourself if a bartender said that beer costs $125.99 for a keg instead of $3.64 for a pint?

Check out the other price comparisons to see how difficult life would be if everything were priced like a payday loan.

If you would like to share this Infographic with your friends, family or readers, please feel free to copy and paste the embed code found below.

To include this image on your website, copy the embed code below and add it to your website: